Posts

Summer Road Trip Preparation

/in Auto Insurance, Insurance Agency Near Me, Insurance Agent Near Me, Insurance Tips /by Catherine DanglerFinding fun activities within your local community can be a great way to spend time with your family this summer. However, summer travel and getaways can be a great way to give your family new and unique experiences; road trips can be a fantastic bonding experience, while at the same time educational. Some tend to avoid road trips with their families because of tales of the intolerable stress they cause; road trips, though, don’t have to be stressful!

Prepare for the Worst: Weekend & Vacation Rental Insurance

/in Auto Insurance, Community, Dickey McCay News, Home Insurance, Insurance Agency Near Me, Insurance Agent Near Me, Insurance Tips, Rental Insurance /by Catherine DanglerEveryone looks forward to a fun family vacation during the summer. Some of my best memories from my childhood have been made during vacations and road trips that I have taken with my parents and siblings. There was always so much to look forward to during these trips: fun games during the long car rides, the interesting stops along the way, and even the forced family photos that we could look back on years later. Since this is something near and dear to my heart, I decided recently to buy a second home to rent out as a vacation property; I wanted to help facilitate memorable vacations for other families, just as I had as a child.

Long Term Care Insurance

/in Dickey McCay News, Insurance Tips, Long-Term Care Insurance /by Dickey McCay TeamLong-Term Care Insurance – Important Information

When my husband was in middle school, his grandmother passed away and his grandfather who was retired and in relatively good health felt he could no longer live alone in his home about five hours away. Then only fourteen years-old, my husband says their family seemed happy to bring in his grandfather. My mother-in-law, however, remembers it a little differently: “It was like having another child,” she told me. “Suddenly I had more laundry, another mouth to feed, someone I had to drive to the doctor or grocery store. I was a wife, mother, teacher, and suddenly a caregiver as well.”

After a month with their new roommate, the family felt it was time for Grandaddy Carter to find an assisted living facility. However, even though he had health insurance and Medicare, they were shocked to find out that neither of these programs pay for any sort of Long Term Care Services. “We had to get the entire family together and talk about how we were going to come together to pay for Dad’s stay,” my father-in-law describes. “We ended up picking up much of the bill ourselves. With young kids and full-time jobs ourselves, it was too much to have him living with us. And we paid for that decision financially, and I am really not sure we could have done so today.”

When I ask their family about this time, they are nostalgic for the time their grandfather’s spent with them, but my mother-in-law can only remember the sheer exhaustion, both physically and mentally. Beyond being stressed, she says she wasn’t sure if she was doing what would be best in the long run for her kids as well as what was best or her father-in-law’s health. “I felt so torn. Looking back I am grateful for the experience and what our family learned and the time we spent together, but at the time it was really difficult. When I look at my kids now I am thankful they got to see what caring for an older person was like, and I wonder which one of them would take care of me one day.”

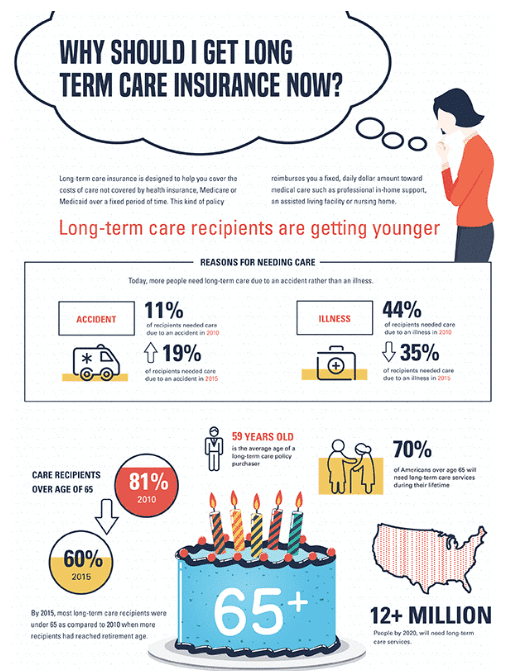

As her own children have moved to different parts of the country hours from home, my mother-in-law decided to buy long-term care insurance for her and her husband at a relatively young (50). Long-term care is essentially all of the services my mother-in-law took care of that are not covered by the typical individual health insurance, including assistance with typical daily activities such as cleaning and dressing oneself, or even simply getting in and out of bed. Since seeing her own father-in-law need help with basic needs, she felt like she needed to take steps that ensured she would be cared for later in life.

With their purchase, they felt like they had some control of their future needs especially with their children away from home. Like most policies, theirs will take care of all of their future needs that many people forget to consider such as assigning a care coordinator to help their family assess future needs, plan for care, and even identify caregivers who can visit them in their home. Their policy also covers home modifications such as ramps or grab bars in the shower so they can stay in their home longer. Ultimately if they do need care beyond in-home care, they can be taken to an assisted living facility/nursing home, allowing our family to be able to afford the best care possible.

When we talk about this now, my mother-in-law speaks about her decision ten years ago with confidence: “My health is good and I believe I will live a long, healthy life. Of course there’s a chance that someday I’ll need help, and when that happens my long-term care insurance will help me to remain in my own home. It will pay for caregivers to do the heavy lifting. When my children or grandchildren visit, it will not be work, it will be to spend time with me.”

Buying long-term care insurance is the best way to prepare for your own or your family member’s futures. Beyond helping in old age, a long-term care insurance policy helps cover the costs of that care when you have a chronic medical condition, a disability or a disorder such as Alzheimer’s disease. I am thankful my mother and father-in-law were aware enough to purchase long term care insurance at an early age, and I hope my own family and others learn to do the same to avoid leaving the burden of care and finances on others.

Helpful Tips and Factors When Searching For Your Long-Term Care Plan

As you begin to look for your plan, we have included four important factors to keep in mind for yourself or perhaps your own parents and grandparents:

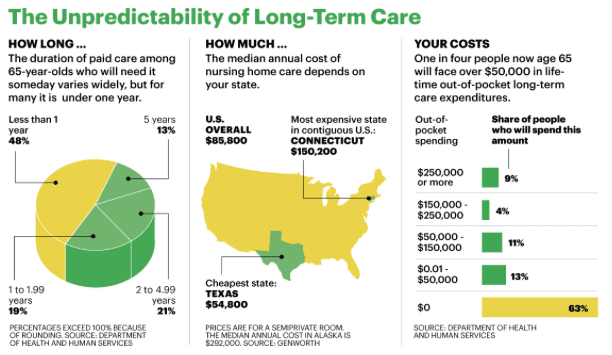

- The earlier you buy long term care insurance, the more affordable your policy will be. Simply put, waiting to purchase coverage until you actually need assisted care is not an option because people who already have a debilitating condition will not qualify for coverage. Most people buy long term care insurance in their mid-50s to mid-60s, but keep in mind that “among 65-year-olds, 70% will use some form of long-term care in the years ahead,” this according to the U.S. Department of Health and Human Service. We suggest buying your long-term care insurance plan when you are around 55-60 years-old because the likelihood of filing a claim before that age is slim. Statistically,“89% of LTC claims are filed for people over age 70.”

- When most people think of purchasing long term care, they assume that regular health insurance or Medicare will provide enough coverage. However, these policies and services only cover limited nursing home stays or small amounts of home health care when you require skilled nursing or even rehabilitation. They also will not cover supervision or assistance with day-to-day tasks.

- The cost of long-term care insurance has a lot of variants:

- Your age and health: The older you are and the more health problems you have, the more you’ll pay when you buy a policy.

- Gender: Women generally pay more than men because they live longer and have a greater chance of making long-term care insurance claims.

- Marital status: Premiums are lower for married people than single people.

- Insurance company: Prices for the same amount of coverage will vary among insurance companies. That’s why it’s important to compare quotes from different carriers.

- Amount of coverage: You’ll pay more for richer coverage, such as higher limits on the daily and lifetime benefits, cost-of-living adjustments to protect against inflation, shorter elimination periods, and fewer restrictions on the types of care covered.

- Prices change: The price could go up after you buy a policy since prices are not guaranteed to stay the same over your lifetime.

- An Example: A single 55-year-old man in good health buying new coverage can expect to pay an average of $1,015 a year for a long-term care policy that pays out $150 a day for up to three years or $164,000 in total benefits, according to a 2016 price index from the American Association for Long-Term Care Insurance. For the same policy, a single 55-year-old woman can expect to pay an average of $1,490 a year. The average combined premiums for a 60-year-old couple, each buying that amount of coverage, are $2,010 a year.

4. There are tax advantages of buying long-term care insurance if you itemize deductions, especially as you get older. The federal and some state tax codes let you count part or all of long-term care insurance premiums as medical expenses, which are tax deductible if they meet a certain threshold. The limits for the amount of premiums you can deduct increase with your age.

As you continue your journey through life, aging, and your role changes within your family, we want to help you make the best decision for your health and finances. Call Dickey McCay today and let us help you decide what Long Term-Care plan is best for you.

Is Long-Term Care Insurance Worth the Investment?

Pet Insurance Provides Added Care

/in Dickey McCay News, Pet Insurance /by Dickey McCay TeamPets are People too! Protect them with Pet Insurance – Right?

It is the New Year, and if you are like many individuals and families, you may have added a family member during the holidays: a new pet!

Pets bring much joy to the lives of their owners, and while many dogs, cats, large animals, fish, reptiles, birds and many other animals are often kept on a “short leash;” other pets may be used for work as a part of your job and enjoy a bit more land and freedom. Whatever the case, pets, like humans, face health issues during their lives due perhaps to their breed’s genetics and/or their environment. At some point, you and your pet will need to visit a veterinarian, perhaps even annually in order to receive preventative vaccines and exams. Beyond this, many pets will at some point in their lives will have to visit the vet for an unexpected sickness or emergency. For example, let’s say your new puppy eats a small toy. When this foreign object reaches your pet’s stomach or intestines, it will obviously need to be removed. Without pet insurance, this procedures costs anywhere between $1,500-$2,000.

Pet Owners Care for their Loving Pets

In reality, pet insurance saves our furry family members’ lives. Dogs that are diagnosed with cancer end up racking up a vet bill around $6,000. If your pet is not covered, what will you do? Will you pay this bill and treat you pet? This amount of money is not easy to swallow no matter what for, but pet insurance can be as low as $20/month and save responsible pet-owners thousands of dollars. Your commitment to your pet’s health has become more expensive due to advances in medical technology for pets and increasing costs of general veterinary care. Without pet insurance, you may not be able to care for pet as well as s/he need and deserves.

Pet Insurance Options Available

There are many pet insurance providers in the marketplace, and many of them offer a variety of pet insurance plans. In general, there are three basic types of coverage:

1) Accident Coverage: While you cannot plan for an accident, you can prevent it from costing you a fortune. Accident coverage what most people choose and can cover problems like a torn ligament, a broken bone, or a bit wound that many animals faces, especially dogs like the ones in the Southeast that are often outside, playing with other dogs, are active, or may be working dogs.

2) Illness Coverage: Illness coverage is quite often limited and becomes more expensive as your pet ages which is why if you have a new pet it is good to purchase your pet insurance while your little critter is still young. It also helps to purchase the coverage when the pet is at a younger age in order to reduce the chances that your pet could have a pre-existing condition as this affects your monthly costs. Illness coverage covers ailments such as cancer, arthritis, UTIs, allergies and more.

3) Wellness Coverage: Wellness coverage is optional and completely depends on how you choose to pay for your pets annual exam/vaccines. For dogs this is every year, for cats veterinarians suggest every three years. These types of exams typically cost between $200-$300. A Pet wellness plan may include:

- Annual exams

- Spay/neuter

- Routine blood panels

- Heartworm testing

- Fecal testing

- Urinalyses

- Routine vaccinations (rabies, DHLP, Bordetella, parvo, Lyme, giardia)

- Teeth cleanings

- Flea, tick and heartworm treatments

After you have decided what of these three your plan will include, there are also a few questions that veterinarians agree customers should ask when deciding which pet health-insurance plan is best for them:

- Question 1: Does the plan will cover preventative pet fees?

- These include annual vaccinations for dogs or every three years for cats, heartworm and fecal exams, flea prevention, and dental cleanings.

- Questions 2: Does your plan include an Annual Coverage Limit?

- The ACL is the total amount you can be reimbursed for over the course of a 12-month policy period.

- Question 3: What is your deductible?

- Like health insurance for humans, a deductible on a pet health insurance plan is the amount you will need to meet before can start getting reimbursed. You can pay a lower monthly premium by selecting a higher deductible or choose a lower deductible if you want the ability to get more money back.

- Questions 4: What are the exclusions of my plan?

- Depending on the plan you choose, there will be some aspects of your pets’ health that is not covered such as breeding costs, cosmetic procedures (like tail docking), and pre-existing conditions or congenital conditions with are often specific to a breed. For example, if your new family member is a German Shepherd, s/he may suffer from Hip dysplasia which is common in larger breeds. Or perhaps you adopted a dog with a pre-existing condition like diabetes. Oftentimes pet-insurance plans will not cover this, but it is best to check.

- Question 5: Does your pets’ plan include a Reimbursement Percentage?

- This is the percentage of covered costs you will have reimbursed once you meet your plan’s deductible. This varies depending on the plan, and can be between 70%, 80%, and 90%. You can choose a lower amount for a lower monthly premium or go with a higher amount if you want to get more cash back on your claims, it is your choice.

- Question 6: Is there a waiting period, and if so how long is it?

- A waiting period is the amount of time that needs to pass before certain coverage kicks in.

With pet insurance, if your new or older pet should become ill or injured, you can visit any licensed veterinarian for treatment without having to worry about if you will able to pay the bills. We hope you and your new or aging pets have a pawsitively happy new year!

After reading this article, if you are interested in protecting your loving pet(s) with a valued pet insurance plan, call Dickey McCay Insurance as a trained professional will be glad to assist you in answering questions or getting a pet insurance policy for your loving pet.

Hours of Operation

Sunday: Closed

Monday: 8:30am – 4:45pm

Tuesday: 8:30am – 4:45pm

Wednesday: 8:30am – 4:30pm

Thursday: 8:30am – 4:45pm

Friday: 8:30am – 4:45pm

Saturday: 9:00am – 12:00pm

Contact Us

Phone: 423-496-3366

Toll Free: 855-876-9779

Fax: 423-496-3368

146 Ocoee St.

P.O. Box 1161

Copperhill, Tennessee 37317