Prepare for the Worst: Weekend & Vacation Rental Insurance

/in Auto Insurance, Community, Dickey McCay News, Home Insurance, Insurance Agency Near Me, Insurance Agent Near Me, Insurance Tips, Rental Insurance /by Catherine DanglerEveryone looks forward to a fun family vacation during the summer. Some of my best memories from my childhood have been made during vacations and road trips that I have taken with my parents and siblings. There was always so much to look forward to during these trips: fun games during the long car rides, the interesting stops along the way, and even the forced family photos that we could look back on years later. Since this is something near and dear to my heart, I decided recently to buy a second home to rent out as a vacation property; I wanted to help facilitate memorable vacations for other families, just as I had as a child.

Get Involved: Summer Fun With Community Events

/in Community, Dickey McCay News /by Catherine DanglerSupport your local community while also having fun in the sun with your family this summer! Attending local festivals and events can be a great way to engage with your community while also providing affordable summer fun for you and your family.

Dickey McCay Insurance Shares Some Local Tourist Activities

/in Community, Dickey McCay News /by Dickey McCay TeamLocal Community and Tourist Favorite Activities

Whether you are vacationing in the Southeast, are a new resident, or were born & raised in one these charming southern towns, there are places and activities that we regail as the “things to do” in the areas we serve. Dickey McCay Insurance has chosen a few of our clients favorite areas to visit, places to eat, and activities to do during your trip or staycation; take it from the locals, these are the places you do not want to miss & the best time of year to see them!

Andrews & Murphy, North Carolina:

- Andrew’s Brewing Company: Operating out of the town’s first jail, this place is where the locals come

to hang out & where tourists come to see the views of North Carolina’s Blue Ridge Mountains. With a fire to sit around come autumn, this is the place to finish your day with friends or make a few new ones.

to hang out & where tourists come to see the views of North Carolina’s Blue Ridge Mountains. With a fire to sit around come autumn, this is the place to finish your day with friends or make a few new ones.  Fire’s Creek is one of the best kept secrets of this area for hiking, horseback riding, swimming & camping. Located in the Nantahala National Forest, you can drive in for some nice creek-side car camping, or enjoy the 23 mile Fires Creek Rim Trail ideal for hiking and horseback riding. This is the perfect place to escape the summer heat with a swim or an easily accessible weekend camping trip. Fire Creek Falls is the waterfall at the end of the dirt road & certainly worth the drive or hike.

Fire’s Creek is one of the best kept secrets of this area for hiking, horseback riding, swimming & camping. Located in the Nantahala National Forest, you can drive in for some nice creek-side car camping, or enjoy the 23 mile Fires Creek Rim Trail ideal for hiking and horseback riding. This is the perfect place to escape the summer heat with a swim or an easily accessible weekend camping trip. Fire Creek Falls is the waterfall at the end of the dirt road & certainly worth the drive or hike.- Harrah’s Casino: The newest attraction in Murphy is Harrah’s Casino boasts 50,000 feet of gambling as well as a massive food court. With an affordable hotel attached, this is the perfect night or weekend getaway to the mountains for some casino fun!

North Carolina’s pristine & scenic Nantahala River offers river rafting through family-friendly rapids that are mild but exciting. The Nantahala features eight miles of practice on easy Class II rapids before splashing through the exciting Class III whitewater of Nantahala Falls. You can go with a guide or rent a raft & take your friends & family down yourself! We recommend going with Nantahala Outdoor Center, one of the most experienced river companies in the Southeast. It also boasts a river-side restaurant & bar to watch as paddlers float down the river & play in the wave!

North Carolina’s pristine & scenic Nantahala River offers river rafting through family-friendly rapids that are mild but exciting. The Nantahala features eight miles of practice on easy Class II rapids before splashing through the exciting Class III whitewater of Nantahala Falls. You can go with a guide or rent a raft & take your friends & family down yourself! We recommend going with Nantahala Outdoor Center, one of the most experienced river companies in the Southeast. It also boasts a river-side restaurant & bar to watch as paddlers float down the river & play in the wave!

Blairsville & Blue Ridge, Georgia:

- Lake Winfield Scott: Lake Winfield Scott Recreation Area offers year-round recreation opportunities including camping, stand up paddling, fishing, picnicking, boating, swimming and hiking, all centered around beautiful Lake Winfield Scott. A Man-Made reservoir, this is the best start and end

loop trail in the area on a hot summer day. The Slaughtercreek Trail in the area climbs the less trafficked area of Blood Mountain with the same beautiful foilage. With camping along the way, this 6 mile trail is both difficult and rewarding.

loop trail in the area on a hot summer day. The Slaughtercreek Trail in the area climbs the less trafficked area of Blood Mountain with the same beautiful foilage. With camping along the way, this 6 mile trail is both difficult and rewarding.  Blood Mountain Hiking: One of the tallest mountains in Georgia, Blood Mountain is one of the first views along with Appalachian Trail where you can get a 360 degree view & the tallest peak along the AT in Georgia. A short, steep hike, this is one of the most frequented hikes in the area, and on a clear day you can even see the Atlanta skyline. Called Blood Mountain for the fables Cherokee & Creek Native tribe’s battle, this hike holds as much lore as views that you do not want to miss.

Blood Mountain Hiking: One of the tallest mountains in Georgia, Blood Mountain is one of the first views along with Appalachian Trail where you can get a 360 degree view & the tallest peak along the AT in Georgia. A short, steep hike, this is one of the most frequented hikes in the area, and on a clear day you can even see the Atlanta skyline. Called Blood Mountain for the fables Cherokee & Creek Native tribe’s battle, this hike holds as much lore as views that you do not want to miss. - Vogel State Park: Vogel State Park, the second oldest state park in Georgia, sits at 2500 feet above sea level right at the base of Blood MountainThe North Georgia Mountains around Vogel were

linked to Native American people for generations before European settlement. With family-friendly camping, easy hikes, a lake with a variety of recreation opportunities, & several waterfall views, Vogel is a must stop when passing through Northeast Georgia.

linked to Native American people for generations before European settlement. With family-friendly camping, easy hikes, a lake with a variety of recreation opportunities, & several waterfall views, Vogel is a must stop when passing through Northeast Georgia. - Mercier’s Orchard: When passing through Blue Ridge, Merciers Orchard is the local spot to take a stroll, explore orchards, pick your own fruit, & find local produce, art, & goodies hailing from the Southeast. Our favorite time to go is in April to pick fresh strawberries straight from the vine to your mouth! And be sure to try and apple pie and Mercier’s wine slushie on the porch; you won’t want to leave!

Tellico Plains, TN & Copperhill, Tennessee:

- Fishing the Tellico River: The drive to the Tellico River is worth the trip even if you never make it to the river, but we definitely suggest not stopping until you reach Baby Falls, a small waterfall on the Tellico River, & taking a moment to take in the magnitude of the large Bald River Falls (pictured here). Beyond just great views, The Tellico also offers incredible kayaking for experienced boaters & is nationally recognized as a premiere trout stream, renowned for brook, brown, and rainbow trout. For fishing, the best time to visit is when the Tennessee Wildlife Agency stocks trout in the Tellico River from March through August. Fishermen here enjoy unspoiled wilderness settings and, more often than not, no company from other fishermen & boaters.

Rafting the Ocoee River: One of the most rafter rivers in the world, the Ocoee river offers rapids ranked from Class III-IV & was even the host of the 1996 Olympics! There are over 42 rafting companies in the area that takes customers down the Middle or Upper Ocoee. The Upper Ocoee boasts the Olympics Whitewater Park & bigger rapids, while the Middle Ocoee is a more scenic, all-natural flow with continuous, class-III fun rapids!

Rafting the Ocoee River: One of the most rafter rivers in the world, the Ocoee river offers rapids ranked from Class III-IV & was even the host of the 1996 Olympics! There are over 42 rafting companies in the area that takes customers down the Middle or Upper Ocoee. The Upper Ocoee boasts the Olympics Whitewater Park & bigger rapids, while the Middle Ocoee is a more scenic, all-natural flow with continuous, class-III fun rapids!- Tour the Breweries: Copperhill, TN hosts a quaint downtown area with a diverse selection of

restaurants, local shops, & new breweries! We suggest taking a stroll around the downtown area & stop in at the three newest breweries: Copperhill Brewery, Buck Bald Brewing, & Copper Ale Station. These hills and their families have been brewing for years & are happy to share their new brews with locals & visitors alike!

restaurants, local shops, & new breweries! We suggest taking a stroll around the downtown area & stop in at the three newest breweries: Copperhill Brewery, Buck Bald Brewing, & Copper Ale Station. These hills and their families have been brewing for years & are happy to share their new brews with locals & visitors alike! - Cherohala Skyway: Known to motor-bike enthusiasts simply as “The Dragon’s Tail,” the skyway offers 43-miles of National Scenic Byway from Tellico Plains, Tennessee, to Robbinsville. As you ride, you will experience ridge after ridge of forested mountain views as far as you can see. Named one of the 10 best rides in North America, there is little evidence of civilization from views that rival or surpass any from the Blue Ridge Parkway, & you will feel like you stepping back in time! We recommend traveling along the road during the fall as the colors are changing & the mountain air is a bit cooler.

Business Insurance

/in Business Insurance, Dickey McCay News, Insurance Agency Near Me, Insurance News /by Dickey McCay TeamSmall to Medium-Sized Business Insurance: Understand Inherit Business Risks

A few years ago a close friend opened a small building-supply company. During his first year in operation, one of his customers bought some paint, took it home, and painted her a bathroom. A few days later she began to clean her walls and noticed the paint starting to peel off. She began scrubbing all around the bathroom and before she knew it she had damaged her newly painted walls and even her trim. She called my friend who’d sold her the paint and realized she had not followed the directions on the can. My friend, the business owner, had also not explicitly told her about the steps she should take prior to painting, so she sued his business.

These types of incidents happen more often than you might think. In fact, according to Forbes Magazine, “36%-53% of small businesses are involved in at least one litigation in any given year and 90% of all businesses are engaged in litigation at any given time.” An unhappy customer can cause your business a lot of money even if you, the business owner, aren’t at fault. If my business-owning friend had bought a Business Owner’s Policy, he would have been able to cover his legal costs accrued during the lawsuit. In these kinds of cases, the insurance company will even appoint a lawyer to defend you in such a case.

Since this incident, my friend has learned a lot about owning a business, and even though his company is quite small with only two employees including himself, he still is at risk by owning a store front with building materials coming in and out every day. Thankfully, he now has Commercial Umbrella Insurance. Just last week he had to use his policy when a contracted painter fell off his ladder at his store. Fortunately with his General Liability policy which is included under his Umbrella plan, his insurance was able to cover the painter’s medical bills and any out of work coverages the painter will need. With a new storefront, this kind of hiccup would have likely put him out of business before he was even able to open his new store. It is during these types of circumstances we realize how vital business insurance is, especially for a small to medium-sized businesses.

You can be an entrepreneur with a great business plan, but these types of events do not pick and choose when they will occur or to whom. These instances could derail your business before it ever really gets going. Before you take the risk of starting your business, we encourage you to sit down with your business plan and budget out the money you will need for business insurance. It will save you money and heartache in the long run.

How Business Insurance Factors Into the Tax Deduction Equation

According to the IRS, you can deduct the ordinary and necessary cost of insurance as a business expense. Most businesses are required to carry various types of insurance because of industry requirements, contractual obligations, and state laws. For example, businesses with employees must have workers compensation insurance and, in most states, provide disability to workers. Because this would classify as both “ordinary and necessary,” the premiums for these insurance policies would fall under the ordinary and necessary rule by the IRS and are deductible; a necessary expense that ends up saving you money in the long run!

What You Likely Can Deduct: Here are a few common types of commercial insurances that would most likely be considered deductible on a corporate tax return for the purposes of operating a small to medium-sized business.

- General Liability Insurance: One of the most common business insurance policies, this typically covers the business for claims involving bodily injury and/or property damage resulting from products, services or operations of the company.

- Professional Liability Insurance: Primarily referred to as errors and omissions insurance, professional liability policies protect businesses against liability incurred as a result of negligence when performing its professional services. Lawyers, engineering firms and insurance brokers are just a few examples of businesses that generally need professional liability.

- Property Insurance Insurance: This type of policy reimburses the owner of a business for the cost of repairing or even replacing damaged or lost business property, such as a warehouse or inventory, due to a covered cause of loss like a fire, bad storm, etc.

- Business Interruption Insurance: Also called business income and extra expense insurance, this is usually part of another policy like the general liability or property policy. It covers for things like lost profits, operating expenses, relocation costs, and payroll, among other things, when the business cannot function normally because of a covered cause of loss.

- Cyber Liability Insurance: One of the increasingly common policies, cyber liability policies cover legal fees/losses when a business is responsible for someone else’s (a customer, for example) data breach and resulting losses. First-party cyber liability can cover recovery costs associated with losses for the business carrying the policy.

- Workers’ Compensation Insurance: Most states mandate that employers carry worker’s comp coverage for their employees. And the states that don’t require it make it extremely expensive for businesses not to carry it. Workers compensation pays an employees’ lost earnings and medical expenses if they are or become injured on the job.

- Commercial Auto Insurance: As the name suggests, commercial auto insurance policies cover liability and property damages resulting from accidents in business-owned vehicles. Important: if you deduct your auto insurance premium, then you cannot take the standard mileage deduction on your taxes. If a vehicle is used partly for business purposes and partly for personal use, you may only deduct that certain percentage of the premium applicable to the business’ use of the automobile.

To Bundle or Not to Bundle?

Depending on the size of your business, you may want to pick and choose the types of policies are best for your business. As your business grows or changes storefronts, or maybe become primarily online, you will likely want to adjust your bundled insurance plan you have created, and this is easy to do especially if you are working with experienced insurance representatives at Dickey McCay who are able to tailor a package to protect your business and give you the peace of mind that comes with knowing you are covered.

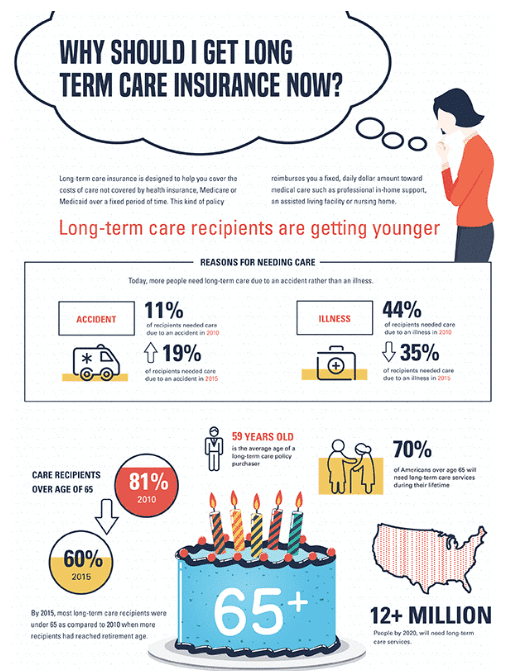

Long Term Care Insurance

/in Dickey McCay News, Insurance Tips, Long-Term Care Insurance /by Dickey McCay TeamLong-Term Care Insurance – Important Information

When my husband was in middle school, his grandmother passed away and his grandfather who was retired and in relatively good health felt he could no longer live alone in his home about five hours away. Then only fourteen years-old, my husband says their family seemed happy to bring in his grandfather. My mother-in-law, however, remembers it a little differently: “It was like having another child,” she told me. “Suddenly I had more laundry, another mouth to feed, someone I had to drive to the doctor or grocery store. I was a wife, mother, teacher, and suddenly a caregiver as well.”

After a month with their new roommate, the family felt it was time for Grandaddy Carter to find an assisted living facility. However, even though he had health insurance and Medicare, they were shocked to find out that neither of these programs pay for any sort of Long Term Care Services. “We had to get the entire family together and talk about how we were going to come together to pay for Dad’s stay,” my father-in-law describes. “We ended up picking up much of the bill ourselves. With young kids and full-time jobs ourselves, it was too much to have him living with us. And we paid for that decision financially, and I am really not sure we could have done so today.”

When I ask their family about this time, they are nostalgic for the time their grandfather’s spent with them, but my mother-in-law can only remember the sheer exhaustion, both physically and mentally. Beyond being stressed, she says she wasn’t sure if she was doing what would be best in the long run for her kids as well as what was best or her father-in-law’s health. “I felt so torn. Looking back I am grateful for the experience and what our family learned and the time we spent together, but at the time it was really difficult. When I look at my kids now I am thankful they got to see what caring for an older person was like, and I wonder which one of them would take care of me one day.”

As her own children have moved to different parts of the country hours from home, my mother-in-law decided to buy long-term care insurance for her and her husband at a relatively young (50). Long-term care is essentially all of the services my mother-in-law took care of that are not covered by the typical individual health insurance, including assistance with typical daily activities such as cleaning and dressing oneself, or even simply getting in and out of bed. Since seeing her own father-in-law need help with basic needs, she felt like she needed to take steps that ensured she would be cared for later in life.

With their purchase, they felt like they had some control of their future needs especially with their children away from home. Like most policies, theirs will take care of all of their future needs that many people forget to consider such as assigning a care coordinator to help their family assess future needs, plan for care, and even identify caregivers who can visit them in their home. Their policy also covers home modifications such as ramps or grab bars in the shower so they can stay in their home longer. Ultimately if they do need care beyond in-home care, they can be taken to an assisted living facility/nursing home, allowing our family to be able to afford the best care possible.

When we talk about this now, my mother-in-law speaks about her decision ten years ago with confidence: “My health is good and I believe I will live a long, healthy life. Of course there’s a chance that someday I’ll need help, and when that happens my long-term care insurance will help me to remain in my own home. It will pay for caregivers to do the heavy lifting. When my children or grandchildren visit, it will not be work, it will be to spend time with me.”

Buying long-term care insurance is the best way to prepare for your own or your family member’s futures. Beyond helping in old age, a long-term care insurance policy helps cover the costs of that care when you have a chronic medical condition, a disability or a disorder such as Alzheimer’s disease. I am thankful my mother and father-in-law were aware enough to purchase long term care insurance at an early age, and I hope my own family and others learn to do the same to avoid leaving the burden of care and finances on others.

Helpful Tips and Factors When Searching For Your Long-Term Care Plan

As you begin to look for your plan, we have included four important factors to keep in mind for yourself or perhaps your own parents and grandparents:

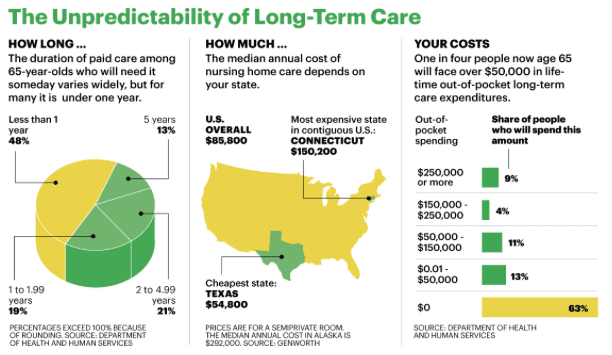

- The earlier you buy long term care insurance, the more affordable your policy will be. Simply put, waiting to purchase coverage until you actually need assisted care is not an option because people who already have a debilitating condition will not qualify for coverage. Most people buy long term care insurance in their mid-50s to mid-60s, but keep in mind that “among 65-year-olds, 70% will use some form of long-term care in the years ahead,” this according to the U.S. Department of Health and Human Service. We suggest buying your long-term care insurance plan when you are around 55-60 years-old because the likelihood of filing a claim before that age is slim. Statistically,“89% of LTC claims are filed for people over age 70.”

- When most people think of purchasing long term care, they assume that regular health insurance or Medicare will provide enough coverage. However, these policies and services only cover limited nursing home stays or small amounts of home health care when you require skilled nursing or even rehabilitation. They also will not cover supervision or assistance with day-to-day tasks.

- The cost of long-term care insurance has a lot of variants:

- Your age and health: The older you are and the more health problems you have, the more you’ll pay when you buy a policy.

- Gender: Women generally pay more than men because they live longer and have a greater chance of making long-term care insurance claims.

- Marital status: Premiums are lower for married people than single people.

- Insurance company: Prices for the same amount of coverage will vary among insurance companies. That’s why it’s important to compare quotes from different carriers.

- Amount of coverage: You’ll pay more for richer coverage, such as higher limits on the daily and lifetime benefits, cost-of-living adjustments to protect against inflation, shorter elimination periods, and fewer restrictions on the types of care covered.

- Prices change: The price could go up after you buy a policy since prices are not guaranteed to stay the same over your lifetime.

- An Example: A single 55-year-old man in good health buying new coverage can expect to pay an average of $1,015 a year for a long-term care policy that pays out $150 a day for up to three years or $164,000 in total benefits, according to a 2016 price index from the American Association for Long-Term Care Insurance. For the same policy, a single 55-year-old woman can expect to pay an average of $1,490 a year. The average combined premiums for a 60-year-old couple, each buying that amount of coverage, are $2,010 a year.

4. There are tax advantages of buying long-term care insurance if you itemize deductions, especially as you get older. The federal and some state tax codes let you count part or all of long-term care insurance premiums as medical expenses, which are tax deductible if they meet a certain threshold. The limits for the amount of premiums you can deduct increase with your age.

As you continue your journey through life, aging, and your role changes within your family, we want to help you make the best decision for your health and finances. Call Dickey McCay today and let us help you decide what Long Term-Care plan is best for you.

Is Long-Term Care Insurance Worth the Investment?

Disability Insurance for Expectant Families

/in Dickey McCay News, Disability Insurance /by Dickey McCay TeamDisability Insurance for Expectant Families

“Worth its Weight in Gold”

Protection During Pregnancy – How does it work?

What is Disability Insurance?

In this blog, we hope to share some information which will answer some questions you may have regarding disability insurance and how it might help as it relates to protection during pregnancy. I didn’t really worry about it until a friend had a close encounter while traveling abroad, so I wanted to update our readers with a few tidbits of information which might answer some questions or save you from getting into the same type of situation as a friend.

Insurance is all about protection- securing you, protecting your family. When we think of insurance, we normally think of the big four: health, home, life, and auto. But what about disability insurance? You may have never heard of it, and if you have, you may have not considered it unless you perhaps work a dangerous job. Even then you probably feel it an unnecessary coverage plan because of worker’s compensation. Consider this though: According to the Council for Disability Awareness, “95% of accident related disability and illnesses are notwork related,” meaning you would not be covered by worker’s comp, and you would be losing your most valuable asset: your ability to make a living.

There are two main types of disability insurance: Short-term and long-term disability policies. A short-term disability policy lasts between 60-90 days after your claim, while a long-term disability policy kicks in after short-term disability would usually have run out and pays you 50%-70% of your gross monthly income. According to one career research website,“some companies and employees say they offer paid leave when they technically offer short-term disability insurance payments that define ‘disability’ to only include childbirth and postpartum recovery.” The insurance payments offered through your disability coverage plan can help cover your expenses while you are unable to work.

The long-term policies typically cover you for periods of 2, 5, or 10 years; or you can choose a plan that will cover you until retirement age. Long-term disability insurance is often referred to as income replacement insurance. It protects you and your family in case you cannot work for extended periods but do not have the savings to live long-term (6+ months) without any income.

But when else in your life might you use the benefits of disability insurance? When might you need time off for an extended period, but you aren’t necessarily never going back to work? Do you plan to have a child? This is the part of disability insurance many people overlook. If you plan to start a family, you can utilize disability insurance if you have a child and intend to take time off to spend with your baby as either a mother or a father.

Let’s look at being a mother first. Women who work face a number of issues when it comes to taking time off to start a family. According to Pew Social Trends, half of two-parent households in the United States have both of the parents working a full-time job. However, the U.S. is the only developed nation that does not legally require their employees be paid for leave when they become new parents. And what about fathers? Not only may he want to stay home to spend time with his new baby and the baby’s mother, but if there is an unexpected outcome from the pregnancy such a premature birth, surgery or sickness, the father may need extended time off to spend with the child and mother at the hospital.

Without paid parental leave, expectant parents will often save their sick leave and vacation time in preparation for the new baby. This is a good strategy for people who have had the same job for quite some time, but does not necessarily work well for people who have yet to collect enough paid days off as s/he will need. If you are counting on employer-provided short-term disability, we highly recommend taking a hard look at the policy terms and benefits. Most plans cover 50% -100% your salary for six weeks of postpartum absence, or longer if you have had a C-section or other medical complications.

Let’s look at a few scenarios:

1) Jodi purchased her short-term disability coverage when she and her husband had been trying to get pregnant for six years. “I knew the policy would cover maternity,” she said, “but I didn’t think I would ever get pregnant. So I got it for general protection with maternity in the back of my mind as a miracle.” In 2010, Jodi got her miracle and gave birth to her son that October. The short-term disability policy provided by her employer allowed six weeks of parental leave, and she used some accumulated paid time off to take two more weeks off since she’d had a C-section. “I needed a little more time to heal,” she said, “and I felt like I got cheated a little since I was down from the surgery.”

2) The second example is from a dear friend of mine, Chelsea. We went to college together, I was in her wedding, and last year she and her husband began trying to get pregnant. One day she called: “We are having a baby in December!” However, just under six months into her pregnancy, she flew with a friend to Greece for a short week-long vacation. On the day they arrived, Chelsea started having pain and had to be rushed to the hospital. The next day she was induced for birth, and she had her first child almost four months early and they both needed to be in the hospital for at least a month, likely longer. Fortunately she and the child are happy and healthy now, but the baby had to stay in the hospital in Greece for four months, which meant she had to live in Greece and miss work. Fortunately she had long-term disability, and she is still at home with her young baby who needs medical attention.

A few additional tips for couples or individuals hoping to start a family:

- If your employer offers basic short-term disability insurance coverage, you could potentially purchase additional coverage through your employer’s plan. Before doing so, we advise that you sit down with your family in order to compare the cost of additional coverage through your employer with the cost of buying a comparable policy on your own.

- It definitely pays to plan ahead. In most circumstances, you must buy the short-term disability coverage prior to getting pregnant. Otherwise, pregnancy will be considered a pre-existing condition and will not be covered.

- Your disability period typically begins on the day you deliver, although it could start earlier if you have medical complications during pregnancy that prevent you from working, such as my friend Chelsea.

- Just to reiterate, if you are planning on getting pregnant, we suggest you check with your benefits department to make sure you understand what types of leave are available to you. There can be a lot of variation by employer within the framework of the Pregnancy Discrimination Act, FMLA, and short-term disability insurance provisions. Remember, in most states, employers are not required to have a short-term disability policy.

Still not sure if you need disability insurance? In the ten minutes it took you to read the above, around 492 people were disabled according to Life Happens Disability Survey. If you still aren’t sure whether you are at risk, we love this quiz that helps you to calculate your Personal Disability Quotient (PDQ). And of course, if you plan to have a baby, get disability insurance as soon as possible.

Dickey McCay Insurance shares in the joy of news of expecting mothers and families as “Community Matters” and the insurance professionals are available to answers questions regarding policies, best companies to use for disability insurance, and willing to search for the best pricing to secure your insurance protection. Call today to get these insurance caring professionals working for you.

Pet Insurance Provides Added Care

/in Dickey McCay News, Pet Insurance /by Dickey McCay TeamPets are People too! Protect them with Pet Insurance – Right?

It is the New Year, and if you are like many individuals and families, you may have added a family member during the holidays: a new pet!

Pets bring much joy to the lives of their owners, and while many dogs, cats, large animals, fish, reptiles, birds and many other animals are often kept on a “short leash;” other pets may be used for work as a part of your job and enjoy a bit more land and freedom. Whatever the case, pets, like humans, face health issues during their lives due perhaps to their breed’s genetics and/or their environment. At some point, you and your pet will need to visit a veterinarian, perhaps even annually in order to receive preventative vaccines and exams. Beyond this, many pets will at some point in their lives will have to visit the vet for an unexpected sickness or emergency. For example, let’s say your new puppy eats a small toy. When this foreign object reaches your pet’s stomach or intestines, it will obviously need to be removed. Without pet insurance, this procedures costs anywhere between $1,500-$2,000.

Pet Owners Care for their Loving Pets

In reality, pet insurance saves our furry family members’ lives. Dogs that are diagnosed with cancer end up racking up a vet bill around $6,000. If your pet is not covered, what will you do? Will you pay this bill and treat you pet? This amount of money is not easy to swallow no matter what for, but pet insurance can be as low as $20/month and save responsible pet-owners thousands of dollars. Your commitment to your pet’s health has become more expensive due to advances in medical technology for pets and increasing costs of general veterinary care. Without pet insurance, you may not be able to care for pet as well as s/he need and deserves.

Pet Insurance Options Available

There are many pet insurance providers in the marketplace, and many of them offer a variety of pet insurance plans. In general, there are three basic types of coverage:

1) Accident Coverage: While you cannot plan for an accident, you can prevent it from costing you a fortune. Accident coverage what most people choose and can cover problems like a torn ligament, a broken bone, or a bit wound that many animals faces, especially dogs like the ones in the Southeast that are often outside, playing with other dogs, are active, or may be working dogs.

2) Illness Coverage: Illness coverage is quite often limited and becomes more expensive as your pet ages which is why if you have a new pet it is good to purchase your pet insurance while your little critter is still young. It also helps to purchase the coverage when the pet is at a younger age in order to reduce the chances that your pet could have a pre-existing condition as this affects your monthly costs. Illness coverage covers ailments such as cancer, arthritis, UTIs, allergies and more.

3) Wellness Coverage: Wellness coverage is optional and completely depends on how you choose to pay for your pets annual exam/vaccines. For dogs this is every year, for cats veterinarians suggest every three years. These types of exams typically cost between $200-$300. A Pet wellness plan may include:

- Annual exams

- Spay/neuter

- Routine blood panels

- Heartworm testing

- Fecal testing

- Urinalyses

- Routine vaccinations (rabies, DHLP, Bordetella, parvo, Lyme, giardia)

- Teeth cleanings

- Flea, tick and heartworm treatments

After you have decided what of these three your plan will include, there are also a few questions that veterinarians agree customers should ask when deciding which pet health-insurance plan is best for them:

- Question 1: Does the plan will cover preventative pet fees?

- These include annual vaccinations for dogs or every three years for cats, heartworm and fecal exams, flea prevention, and dental cleanings.

- Questions 2: Does your plan include an Annual Coverage Limit?

- The ACL is the total amount you can be reimbursed for over the course of a 12-month policy period.

- Question 3: What is your deductible?

- Like health insurance for humans, a deductible on a pet health insurance plan is the amount you will need to meet before can start getting reimbursed. You can pay a lower monthly premium by selecting a higher deductible or choose a lower deductible if you want the ability to get more money back.

- Questions 4: What are the exclusions of my plan?

- Depending on the plan you choose, there will be some aspects of your pets’ health that is not covered such as breeding costs, cosmetic procedures (like tail docking), and pre-existing conditions or congenital conditions with are often specific to a breed. For example, if your new family member is a German Shepherd, s/he may suffer from Hip dysplasia which is common in larger breeds. Or perhaps you adopted a dog with a pre-existing condition like diabetes. Oftentimes pet-insurance plans will not cover this, but it is best to check.

- Question 5: Does your pets’ plan include a Reimbursement Percentage?

- This is the percentage of covered costs you will have reimbursed once you meet your plan’s deductible. This varies depending on the plan, and can be between 70%, 80%, and 90%. You can choose a lower amount for a lower monthly premium or go with a higher amount if you want to get more cash back on your claims, it is your choice.

- Question 6: Is there a waiting period, and if so how long is it?

- A waiting period is the amount of time that needs to pass before certain coverage kicks in.

With pet insurance, if your new or older pet should become ill or injured, you can visit any licensed veterinarian for treatment without having to worry about if you will able to pay the bills. We hope you and your new or aging pets have a pawsitively happy new year!

After reading this article, if you are interested in protecting your loving pet(s) with a valued pet insurance plan, call Dickey McCay Insurance as a trained professional will be glad to assist you in answering questions or getting a pet insurance policy for your loving pet.

Homeowners Insurance Bringing Good Cheer!

/in Dickey McCay News, Home Insurance /by Dickey McCay TeamHomeowners Insurance Protecting All Through the Night!

If you are a new homeowner and are having trouble ciphering through homeowners insurance, you are not alone! In fact, only about half of people who have homeowners insurance claim to fully understand their own policy.

As with most purchases these days, we suggest doing your own research before you settle on a plan. By looking around the web and comparing plans and rates, you will not only have a better understanding for what is best for you, but you can also adjust expectations for what you want your own policy to cover. By having a full understanding of your homeowners insurance, you will feel satisfied and sure when the time comes to get the coverage you need.

Learning the ABCs of Homeowners Insurance

To help you understand homeowners insurance and find the policy that is best for you and your family, we have brought the basics to you.

- What is homeowners insurance?

- In short, homeowners insurance is a type of property insurance that covers private residences by offering financial protection in case of certain types of accidents, burglaries or natural disasters that affect your home. Usually this means that these four aspects are covered: 1) structural damage, 2) personal belongings, 3) liability and 4) additional living expenses.

1) …So What is Structural damage?

- This is one of the key differences between homeowners and renters insurance. Let’s say your condo suffers damage from by burglars or is destroyed by a hurricane, homeowners insurance can cover the costs of repairing, or in some cases even rebuilding it. Your mortgage lender might refer to this as “hazard insurance”, but don’t let that confuse you, this is simply just part of your homeowners policy. We think the best perk of structural damage is that is covers parts of your home that may not even be physically attached to your home, like maybe your shed or garage.

2) What does and does not constitute as “personal belongings”?

Personal belongings that are stolen, damaged, or destroyed by an included disaster on your policy may include:● Clothes

● Furniture

● Appliances

● Computers

● TV and accessories

● Home Decor & Art

● Wine/Spirits

● Sports Equipment

● Toys/Gadgets

● Electronics

●Outdoor Additions (ie, grill, patio furniture, etc.)

Generally speaking, the level of coverage for personal belongings is a percentage of your home’s insured value. For example, if your home is insured up to $200,000, and personal belongings coverage amount is 50% of this, the limit will be $100,000. The actual percentage used varies, however, depending on your policy.

3) What does Liability protection cover?

- Liability protection covers lawsuits against bodily injury or property damage that you, your family and your pets may cause to someone visiting your home. This type of protection typically covers court costs and any awards you may have to pay in court. Your policy should also include Medical Payments Insurance so that if a visitor is hurt at your place of residence, their medical bills can be paid by your insurance company. All of this language and protection can be overwhelming, so when you talk with the experts in the insurance business, you are moving in the right direction toward making sure Liability Insurance protects you.

4) Why would I need additional living expenses in my insurance policy?

- In times of crisis, there will be things you need that you may have not expected. What if your home burnt to the ground? Where would you stay? Under homeowners insurance, your policy would cover the necessary additional living expenses (ALE) when you need to live away from your home. These expenses can include housing, meals, storage fees, etc. And if you rent or do Air BnB for a room or portion of your home, the amount you you would have collected while your home is being repaired will also be covered; win win!

** Note: If you are wondering about Earthquake and/or Flood Insurance, most knowledgeable and experienced insurance agencies can quote and add those coverages either onto your existing policy or a separate policy. When you are thinking about different types of crisis protection, one has to consider earthquake, flood or fire as we have seen devastating damage in the California and some have felt the minor earthquake here in the Tennessee, North Carolina and Georgia Tri-State area.

So what will homeowners insurance NOT cover?- Typical wear and tear

- Damage caused by an earthquake or flood

- Mold caused by high humidity or preventable water leak

How Much Insurance Should I Consider to Protect My Home?

- There isn’t one right answer. But here are a few things to consider when factoring how much coverage you need:

- Current construction costs: In the case your home would have to be completely rebuilt from the ground up, you will need to factor: square footage of your home, type of materials used, special features, and style of your home.

- The value of your personal belongings: To figure out how much coverage you need, conduct a home inventory including:

- Photos of all your belongings

- Write down details of your items (make, model, serial numbers, place of purchase and what you paid)

- Keep receipts and credit card statements

OK. Now I understand what is and isn’t covered in Homeowners insurance policies, but what are the different types of policies?

The different types of policies are known as “forms” and are categorized into the following:

HO-1: Basic policy-The simplest policy; covers 10 specific perils. You may be able to get coverage for belongings inside your home, but it is not offered in many states.

HO-2: Broad policy- Covers all 10 perils included in an HO-1 policy along with an additional six perils. They usually cover not only the structure of your home, but your personal belongings as well. It may also cover liability protection.

HO-3: Special policy- The most common type of policy; provides financial protection from all perils unless noted.

HO-5: Comprehensive policy-Similar to an HO-3 policy, except it offers greater coverage with your belongings and liability protection.

HO-8: Older home policy-This policy is created for older homes where the cost to replace the home is higher than its actual cash value.

How much does homeowners insurance cost?The average annual premium for homeowners insurance in 2015 was $1,173 according to the National Association of Insurance Commissioners (NAIC). However, these costs vary from state to state. For instance, the average premium for a private dwelling in Utah is $673 a year, while in Florida it averages $1,993.

There are myriad factors that affect the overall cost of homeowners insurance:

- Location: Areas that are have a high population density tend to have higher real estate and construction costs, this tends to affects the cost of homeowners insurance.

- Odds of catastrophe. Certain areas in the U.S. are more prone to certain types of catastrophe. For instance, the Carolinas, Florida, and Alabama tend to experience hurricanes which can affects insurance costs.

- Construction costs. The cost of construction depends on the type of residence, how large it is, building materials, building regulations, climate, etc.

● Age of your home

● Square footage of your home

● Construction type

● Number of inhabitants

● Crime in the neighborhood

● Roof type

● Your claim history

● Your credit score

● If you have a home security system in place

● If you have pets

● Your deductible the total amount you’d like covered

Tips on purchasing homeowners insurance- Avoid taking out a policy where claims would be settled by the Actual Cash Value of the items damaged or destroyed. Because of depreciation, the money you receive will generally be less than what you would need to replace items that get damaged.

- Use a local insurance agency. Time and time again we see people simply choosing the cheapest policy without meeting with an agent. Then once they need to be covered, there is no agent they are familiar with and there is no one to fight for their claim. Experts agree your best bet is go with a local company where agents pick up the phone, know your name and policy well, and work hard for you before you need assistance.

- Don’t make claims; if you already have a policy, try to minimize the amount of claims you make. Because this has the potential to increase your premiums so if the amount you claim for is relatively low, you might end up saving money by holding off making a claim and keeping your premiums low.

Insurance can feel confusing and complicated without a professional’s help. We hope we have helped you understand the ins and outs of homeowners insurance. When you feel it is time to get more help, don’t hesitate to reach out to a licensed professional. The agents at Dickey McCay Insuranceare able to communicate the important details that can seem muddled amongst all of the wording and paperwork. Our goal is for you to make an informed decision regarding your policy, potential rates, and every aspect of coverage across many companies. We can help you meet all your insurance needs in a one-stop shop at Dickey McCay Insurance!

Shopping Cheapest Insurance

/in Community, Dickey McCay News /by Dickey McCay TeamShopping the Best Insurance Quotes

When you begin looking for a new insurance plan, it can become quite overwhelming with the masses of insurance companies as well as each of their unique websites and the online insurance quotes they offer. Many of these services willgive you an insurance quote quickly, and on the surface they seem to offer a cheap quote for different types of coverages. If you are young, single, and not paying a mortgage, then getting insurance online on something small such as your car may be a great option. However, purchasing insurance via the internet which can seem like a cheap solution can often lead to more hassle than it is worth. We suggest using these online quotes as a means of understanding insurance rates and using what you learn about pricing to use as a reference when calling your local agent to get their expert opinion and direction moving forward. The online quote you find can be your guide when discussing what you do and do not need covered in your plan. For instance, last month I was searching for new car insurance, so I did what most do and got online to shop around for the best rates. After gathering quotes and a detailed list of what is covered, I took these reports to my local insurance agent. Small, local agencies like Dickey McCay provide not only excellent insurance support based on their expert knowledge of the insurance industry, but they are also able to sit down with you one-on-one to discuss insurance rates, what is covered in what instances, and the best policies for you and your family.

Does Cheaper Insurance Rates Mean Cheap Insurance?

These days, companies and online platforms market to potential customers as an opportunity to shop for the “cheapest ” car insurance or purchase insurance at perhaps a cheaper rate than what the customer is currently receiving. While we are all looking for the best rates on different types of insurance, it is important to understand the value of talking with a local insurance professional who specializes in listening to the customer’s insurance needs, sharing their understanding and then researching the best insurance policy and price for them. For example, when I was looking for car insurance, the quote I found online had a low deductible for collision insurance making my premium higher. After speaking with my local agent, she suggested that I did not need a lot of collision insurance as I have an older vehicle; however, my father has a new car, so his collision coverage needs to be able to cover the cost of any fixes his car may need, thus a lower deductible. Often these rates depend on your age, assets, etc. which is why an insurance agent can help guide you towards the perfect plan for you.

These days, companies and online platforms market to potential customers as an opportunity to shop for the “cheapest ” car insurance or purchase insurance at perhaps a cheaper rate than what the customer is currently receiving. While we are all looking for the best rates on different types of insurance, it is important to understand the value of talking with a local insurance professional who specializes in listening to the customer’s insurance needs, sharing their understanding and then researching the best insurance policy and price for them. For example, when I was looking for car insurance, the quote I found online had a low deductible for collision insurance making my premium higher. After speaking with my local agent, she suggested that I did not need a lot of collision insurance as I have an older vehicle; however, my father has a new car, so his collision coverage needs to be able to cover the cost of any fixes his car may need, thus a lower deductible. Often these rates depend on your age, assets, etc. which is why an insurance agent can help guide you towards the perfect plan for you.

Local Insurance Agencies with Experience Provide Value

As you attain more assets, you will also benefit from having someone in the business who has experience handling multiple insurance policies and/or umbrella coverage. When you are looking for an affordable rate, you may get what you ask for from an online insurance tool in finding a cheap insurance rate, but what you may not get is the the best policy for you to protect your insurance assets – you, family, healthcare, auto insurance, life insurance, etc. Online quotes are simply a starting point when shopping around.

Finding quotes online through automated search platforms can be helpful, but the local agencies with trained insurance professionals you know bring added value to ensure you get the best deal (value) for the money you are investing each month. Then when the time comes to get a claim paid, the same agent you have been working with all along will then assist in ensuring you get what you are owed. At a small, local agency like Dickey McCay, you will have an agent who answers the phone and goes to work for you so that you are covered when needed. Smaller, experienced, hard-working local insurance agencies like Dickey McCay Insurance will fight for you and aid in helping you create the best policy for you and your family. These are a few of the important benefits you should consider when searching for the best quote. Sure, there will be some pricing online that will look tempting and even push you hard to hit the enter button to complete the transaction, but one needs to think and weight out personal touch, pricing, experience, community support (giving back) and background of insurance company, etc.

agency like Dickey McCay, you will have an agent who answers the phone and goes to work for you so that you are covered when needed. Smaller, experienced, hard-working local insurance agencies like Dickey McCay Insurance will fight for you and aid in helping you create the best policy for you and your family. These are a few of the important benefits you should consider when searching for the best quote. Sure, there will be some pricing online that will look tempting and even push you hard to hit the enter button to complete the transaction, but one needs to think and weight out personal touch, pricing, experience, community support (giving back) and background of insurance company, etc.

At Dickey McCay, you will sit with a trained professional insurance agent (person) and be able to call him/her as needed. You are not just a number in a huge corporate insurance agency but a personal name with a face who needs insurance support.

Local Insurance Agencies Care About their Community

What Dickey McCay Insurance wants is what is best for you. They value and support the communities they serve, and as your local insurance agency, they can guide you to secure the best insurance policy for you at the most affordable price based on the highest quality of the insurance company when it comes to purchasing an insurance policy and supporting a future claim. It’s all about treating people like you want to be treated – fair, honest and caring.

Hours of Operation

Sunday: Closed

Monday: 8:30am – 4:45pm

Tuesday: 8:30am – 4:45pm

Wednesday: 8:30am – 4:30pm

Thursday: 8:30am – 4:45pm

Friday: 8:30am – 4:45pm

Saturday: 9:00am – 12:00pm

Contact Us

Phone: 423-496-3366

Toll Free: 855-876-9779

Fax: 423-496-3368

146 Ocoee St.

P.O. Box 1161

Copperhill, Tennessee 37317

to hang out & where tourists come to see the views of North Carolina’s Blue Ridge Mountains. With a fire to sit around come autumn, this is the place to finish your day with friends or make a few new ones.

to hang out & where tourists come to see the views of North Carolina’s Blue Ridge Mountains. With a fire to sit around come autumn, this is the place to finish your day with friends or make a few new ones. Fire’s Creek is one of the best kept secrets of this area for hiking, horseback riding, swimming & camping. Located in the

Fire’s Creek is one of the best kept secrets of this area for hiking, horseback riding, swimming & camping. Located in the  North Carolina’s pristine & scenic Nantahala River offers river rafting through family-friendly rapids that are mild but exciting. The Nantahala features eight miles of practice on easy Class II rapids before splashing through the exciting Class III whitewater of Nantahala Falls. You can go with a guide or rent a raft & take your friends & family down yourself! We recommend going with Nantahala

North Carolina’s pristine & scenic Nantahala River offers river rafting through family-friendly rapids that are mild but exciting. The Nantahala features eight miles of practice on easy Class II rapids before splashing through the exciting Class III whitewater of Nantahala Falls. You can go with a guide or rent a raft & take your friends & family down yourself! We recommend going with Nantahala loop trail in the area on a hot summer day. The Slaughtercreek Trail in the area climbs the less trafficked area of Blood Mountain with the same beautiful foilage. With camping along the way, this 6 mile trail is both difficult and rewarding.

loop trail in the area on a hot summer day. The Slaughtercreek Trail in the area climbs the less trafficked area of Blood Mountain with the same beautiful foilage. With camping along the way, this 6 mile trail is both difficult and rewarding.  Blood Mountain Hiking

Blood Mountain Hiking linked to Native American people for generations before European settlement. With family-friendly camping, easy hikes, a lake with a variety of recreation opportunities, & several waterfall views, Vogel is a must stop when passing through Northeast Georgia.

linked to Native American people for generations before European settlement. With family-friendly camping, easy hikes, a lake with a variety of recreation opportunities, & several waterfall views, Vogel is a must stop when passing through Northeast Georgia.

Rafting the Ocoee River:

Rafting the Ocoee River: restaurants, local shops, & new breweries! We suggest taking a stroll around the downtown area & stop in at the three newest breweries: Copperhill Brewery, Buck Bald Brewing, & Copper Ale Station. These hills and their families have been brewing for years & are happy to share their new brews with locals & visitors alike!

restaurants, local shops, & new breweries! We suggest taking a stroll around the downtown area & stop in at the three newest breweries: Copperhill Brewery, Buck Bald Brewing, & Copper Ale Station. These hills and their families have been brewing for years & are happy to share their new brews with locals & visitors alike!